Invest in the Leading VR Esports Company Today

Written on

The Intersection of VR and Esports

The fusion of two enormous markets is taking shape, with one company at the forefront of this evolution.

Photo by stephan sorkin on Unsplash

In recent years, major investments have been funneled into the virtual reality (VR) sector, notably by Facebook. This influx of capital has facilitated a significant shift in the market dynamics. Once, acquiring a VR headset required a hefty sum, along with a high-performance computer. Now, the Oculus Quest 2 is available for as little as $299, making VR more accessible than ever. This accessibility is projected to drive market growth at an impressive rate of over 19% annually for the next five years, opening up numerous opportunities as interest continues to rise.

Simultaneously, the esports industry has also witnessed rapid growth. Once a niche interest, esports has exploded in popularity, especially with platforms like Twitch gaining traction. Events that previously required physical attendance can now be streamed to millions globally, fundamentally changing how esports is consumed. Nowadays, competitive games rely heavily on an esports following to remain relevant, as this community shapes gameplay strategies, keeps players engaged, and nurtures newcomers.

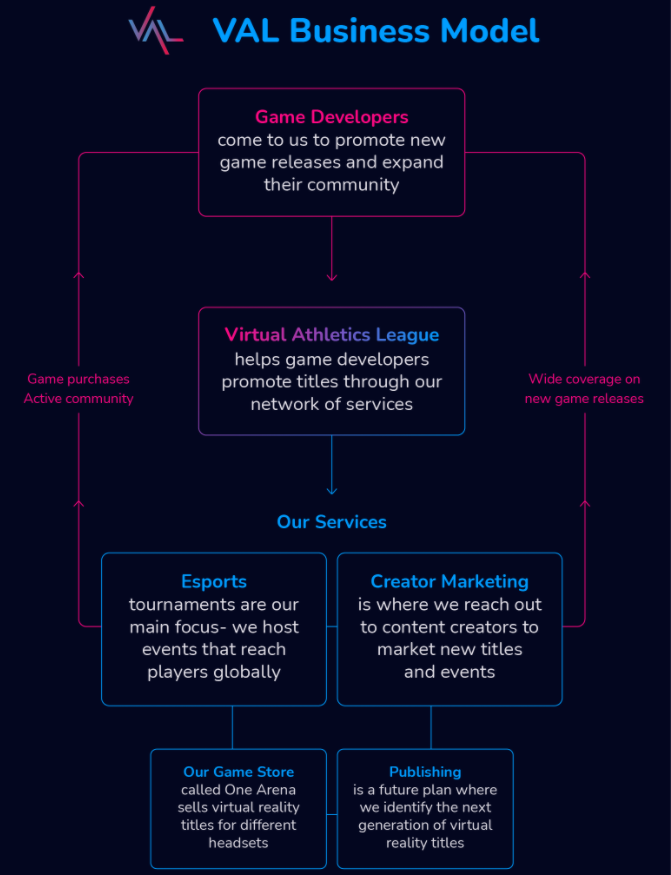

Enter VAL: The Virtual Athletics League. This company has recently launched on StartEngine, and their business model appears promising.

What VAL Brings to the Table — 9.5/10

VAL features diverse revenue streams and innovative components within its business model. Their integration across various sectors is unique and intelligent, setting them apart from competitors.

Their two main offerings are particularly noteworthy. First, VAL organizes traditional esports events. For smaller game developers lacking the audience or expertise to host their own competitions, VAL acts as a partner to facilitate esports events. This customizable approach can help drive traffic to new games, amplifying visibility and engagement.

Additionally, VAL offers proprietary software that enables companies to host tournaments. This can be licensed for various events and seasons, tapping into another lucrative segment of the market.

Game Sales & Marketplace

VAL is also venturing into the game sales arena, aiming to compete with established platforms like Steam, specifically in the VR space. Their initiative, dubbed "One Arena," could potentially position them as the go-to marketplace for VR gaming, paving the way for tremendous growth.

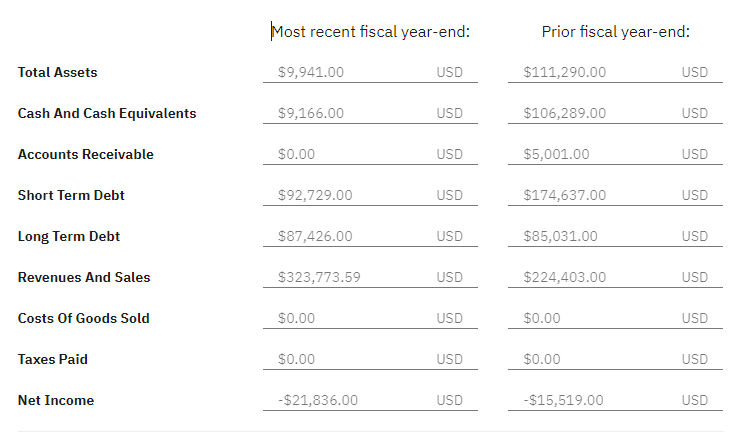

Financial Overview — 9.5/10

When evaluating a company, financials are crucial. VAL is currently valued at $10 million, which is attractive given their substantial revenue generation. They are recognized as the largest VR esports platform based on revenue.

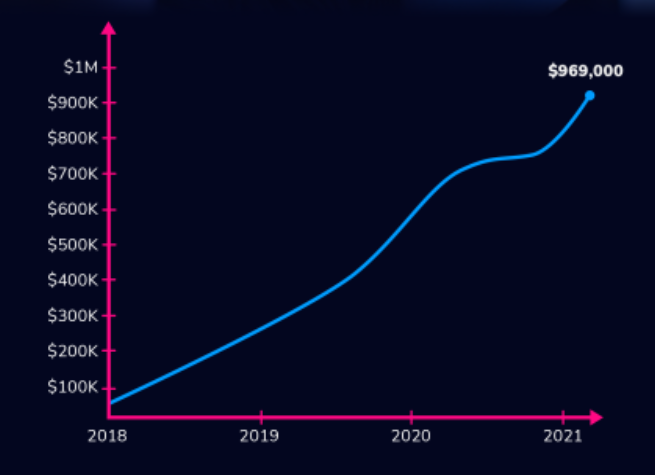

Over the past three years, VAL has generated nearly $1 million in revenue, with impressive growth rates:

- 2019: $224k

- 2020: $323k

This translates to a year-over-year growth rate of approximately 45%. If this momentum continues, their revenue could approach half a million in 2021, resulting in a valuation of around 21 times last year's revenue, which appears reasonable.

Debt and Profitability

Remarkably, VAL is close to operating at a profit, having only lost about $20,000 per year over the last two years. This positions them well for sustainability, especially if they successfully maximize their $1 million funding goal.

They plan to allocate funds to promote their game store, which has incurred significant initial costs. Achieving their minimum fundraising goal could make them cash-flow positive, enabling long-term operations.

Dilution and Risk Assessment

As always, dilution is a concern with fundraising. However, with only $70,000 in SAFEs yet to convert, dilution risks appear minimal. The offering circular presents no significant red flags, instilling confidence in potential investors.

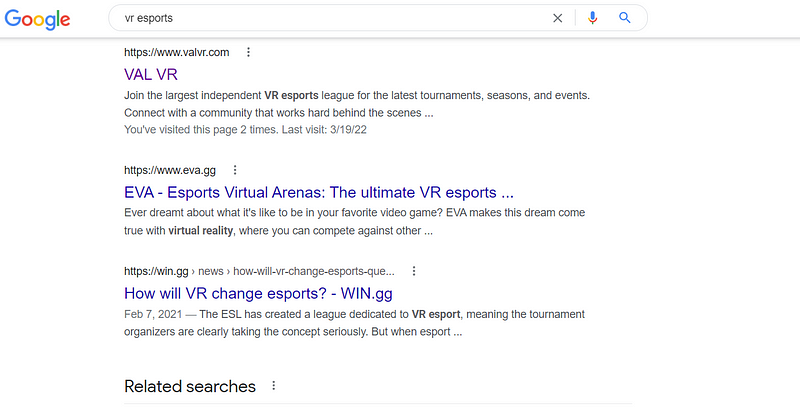

Competition and Market Landscape — 8.5/10

As with any sector, competition exists. VAL has managed to secure a spot on the first page of Google for "VR esports," a notable achievement, considering the competition.

While the search term isn't highly trafficked yet, it’s on the rise. If VAL can capture this growing interest, they stand to benefit significantly as VR esports become more mainstream.

Market Potential and Competitors

The leading player in this domain is ESL, a billion-dollar entity in traditional esports. While ESL focuses primarily on promotion and events, they do not engage in game sales. The esports market is projected to grow by about 20% annually, providing ample opportunity for VAL.

Additionally, platforms like Steam and Epic are major players with substantial revenues. Even niche platforms like Itch.io are likely billion-dollar operations, highlighting the significant potential in this space.

Bull Case

As VAL approaches cash-flow positivity, they have the potential to expand their market share. If they can establish dominance in the sector, their valuation could easily exceed $100 million. Future growth could involve creating their own games, launching esports leagues, and hosting large-scale events.

A notable acquisition in the esports realm involved Activision purchasing MLG for $50 million in 2016, a time when esports were just beginning to gain traction. If VAL can scale effectively, they may find themselves in a similar position.

Bear Case

While VAL claims the top spot in revenue and following, competition from similarly sized companies could pose challenges. If they fail to carve out a sustainable niche or are outperformed by established players, growth could stagnate. However, with their trajectory towards cash-flow positivity, complete failure seems unlikely.

Founders and Team — 6.5/10

The founding team lacks notable exits, which could be a drawback. Founders with previous successes tend to have a higher likelihood of success. Nevertheless, the team has experience in the VR sector, albeit limited due to the industry’s novelty.

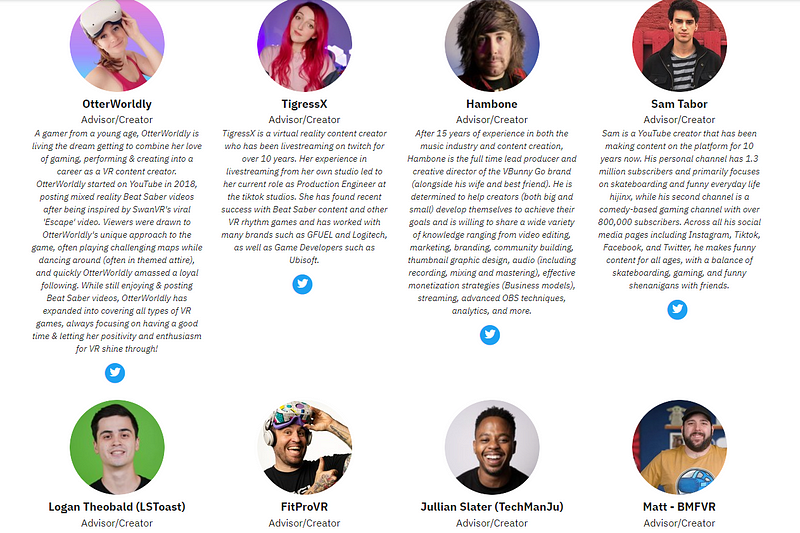

Collaborating with Creators and Studios

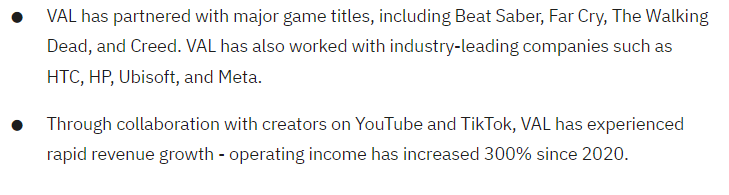

VAL is rapidly establishing partnerships with content creators and gaming studios. Many of these creators have millions of followers in the VR community, which can significantly enhance VAL's visibility and market reach.

If they manage to work with a gaming studio that develops the next blockbuster VR title, VAL will benefit greatly from early market dominance.

Traction — 8.5/10

Overall, VAL demonstrates impressive traction. Even a modest YouTube channel with a consistent and growing audience can generate substantial revenue, serving as excellent promotion. Their Twitch channel further contributes to revenue alongside their game store and esports events.

I consider early traction to be vital, as it indicates the company's ability to execute and the existence of a market for their offerings. With established partnerships and a solid foundation, VAL is well-positioned for growth.

Conclusion and Rating

In conclusion, VAL presents a robust business model with solid growth potential. Their diverse revenue streams and effective partnerships suggest a promising future. I will assign a rating based on the criteria discussed, resulting in a score of 85/100.

Additionally, there is a 20% discount on shares for early investors, which could enhance this rating if leveraged effectively. While perfection is elusive, this score reflects a strong investment opportunity. I will continue to seek out companies scoring above 75, including VAL.

Explore the top five virtual reality stocks that could lead to real wealth in the evolving tech landscape.

Discover which metaverse companies are positioned to outperform Meta and Facebook in the competitive digital landscape.

Social Media Presence

VAL's growing social media presence is a strategic asset for long-term engagement. They boast:

Their YouTube and Twitch channels are particularly noteworthy, with several viral videos that contribute to audience growth and engagement.